Sugar industry wins higher support prices, but faces other problems

Sugar-RFP-081825

TRAVERSE CITY, Mich. — The U.S. sugar industry won a major victory in the reconciliation bill when Congress raised the loan rates for sugar for the first time in many years, but the industry faces many other problems including inflation and flat or declining consumer demand, experts said at the American Sugar Alliance’s International Sweetener Symposium here last week.

| The reconciliation bill, officially the One Big Beautiful Bill Act, raised the loan rates from 19.75 cents to 24 cents per pound for raw cane sugar and from 25.4 to 32.77 cents per pound for refined beet sugar, said Rob Johansson, the director of economics and policy analysis for the American Sugar Alliance, who moderated several panels at the meeting. One of the factors in convincing Congress to pass the increase in the loan rate was that both the American Sugar Alliance, which represents the beet and cane growers, and the Sweetener Users Association supported the increase. |

In most past years, the growers have favored an increase while the users have tried to keep the support price lower.

Randy Green of Watson-Green LLC, a consultant to the sweetener users, said that in the agriculture section of the reconciliation bill “we supported its sugar provisions, loan rates and CCC storage rates were increased, and this reflects the very real rising cost of production that you’ve all faced.”

“Sugar users value our domestic suppliers. They have a preference for domestic sugar. … We hope to continue working together with you on policies to benefit growers and users alike,” he said.

Congressional policy directs the Agriculture Department to try to keep sugar prices above the loan rate levels by limiting the imports in a given year. But if sugar prices fall below the loan rate levels, growers have the right to be paid the loan rates in return for delivering the sugar to the federal government.

Green noted that the higher loan rates “increase the odds of forfeitures” of sugar to the federal government.

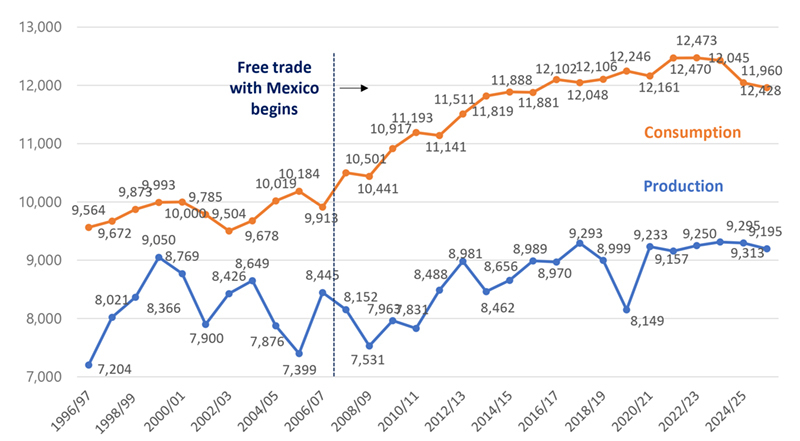

U.S. producers usually grow about 75% of the sugar used in the United States by companies and households.

Green noted that it’s harder than it used to be for USDA to determine how much sugar is needed. Consumer demand has become harder to estimate and companies have been reformulating products in line with pressures to reduce the addition of sugars to food, he said. Countries have tariff rate quotas, but companies have been importing sugar above those quotas, which means higher prices, he added.

Companies do not share their purchasing plans with the Sweetener Users Association, Green said. Even if domestic prices go lower, companies continue to fulfill the contracts for imports, an attendee explained.

“In just the past two years, prices for sugar beet and sugarcane farmers have fallen by 26% and 13%, respectively,” ASA said in a news release.

“Those prices continue to fall as foreign nations that subsidize their own domestic industries are expected to dump near record amounts of sugar on the world market.”

Since 2010, consumer prices have risen while producer prices for sugar have remained flat and farmers’ costs have soared, Johansson said.

Jeff Dobrydney, the senior vice president of JSG Commodities, said that high prices for retail food items may be playing a role in reducing consumer demand for sugar-containing products, but he also said data is showing that the rising use of GLP-1 drugs to reduce people’s appetites is also affecting consumption.

José Orive, executive director of the International Sugar Organization, presented a portrait of the sugar industry worldwide and said, “According to market fundamentals, we have a massive deficit, prices should be high. However, stock draw downs, speculative market behavior, currency movements, shifts in ethanol diversion, and broader economic factors all have contributed to weaker sugar prices.”

Increases in sugar consumption are coming from population growth, not individual decisions to buy sugar-containing products such as soda and candy, Orive said.

“Consumption dynamics remain an enigma,” Orive said, with GLP-1 receptor agonists, ultra-processed food, reformulations and regional population growth all playing a role.

In the years 2025 and 2026, Orive said, “the global sugar balance is turning to a modest surplus after a significant deficit in 2024-25, but anticipated rises in production are likely to outpace any global consumption increase.”

Market prices may rise in the short run because weather in the beet regions of Europe and Russia is “problematic,” and Brazil is dry, he said. Another complicating factor is how much Brazil uses sugar to make ethanol. Corn ethanol is taking a larger share of Brazil’s ethanol market, Orive said.

Dobrydney said sugar needs in the United States will be affected by President Trump’s plan to impose 50% tariffs on all products from Brazil, the recently announced reduction in the specialty sugars quota, the fact that Florida Crystals is the only organic producer in the United States, and Coca-Cola’s announcement that it will sell a version of Coke made with cane sugar rather than high-fructose corn syrup.

An attendee at the conference said that Central American sugar is likely to be important to the United States if tariffs on Brazilian sugar make sugar from that country too expensive. Containers of sugar coming into the United States are all marked by country of origin and importers are used to checking the containers and pay tariffs at the rate for that country, the attendee said.

For many years USDA has sent one of the civil servants who manages the sugar program to the symposium, but this year USDA sent only Agriculture Deputy Secretary Stephen Vaden. Johansson said he wanted to send “long distance” greetings to these workers.