Disparate conditions in crop and livestock sectors evident in credit conditions

Credit1-RFP-111725

Agricultural credit conditions in most of the region deteriorated gradually during the third quarter of 2025, but strength in the cattle sector improved farm finances in some areas. According to the Tenth District Survey of Agricultural Credit Conditions, farm income and credit conditions weakened at a pace similar to recent quarters in portions of the region most dependent on crop revenues. Despite further tightening, financial conditions generally remained stable and lenders in areas more dependent on cattle revenues reported higher incomes and steady loan quality. Providing ongoing support to the sector, cropland values remained firm and ranchland values increased modestly.

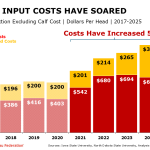

Weakness in the crop sector continued to weigh on the outlook for the U.S. farm economy despite a boost to incomes in some regions from strength in the livestock sector and recent increases in corn and soybean prices. The depletion of working capital alongside elevated production costs has increased demand for financing and growth in farm debt has been strong among agricultural lenders. The distribution of assistance from the American Relief Act earlier in the year provided modest support and financial stress has remained relatively limited, but a continuation of limited profits among crop producers may drive further deterioration in credit conditions during the coming months.

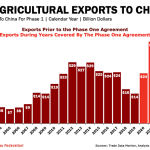

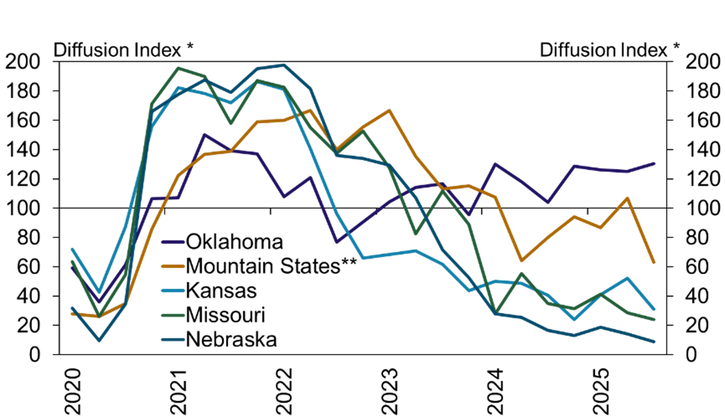

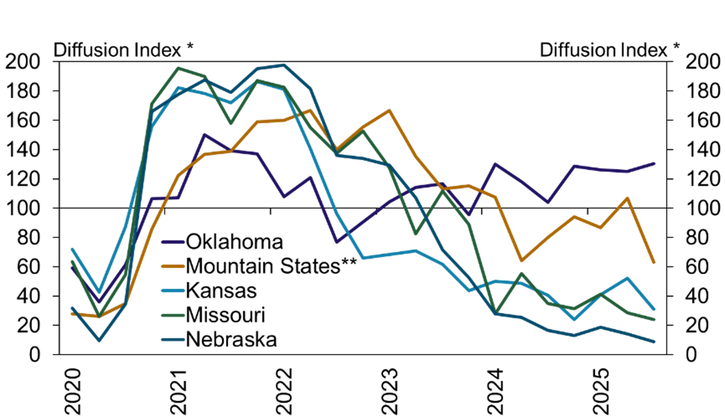

Relatively weak crop prices continued to weigh on farm income in most of the district. The share of lenders reporting lower farm income from a year ago increased in Kansas, Missouri and Nebraska, where row crop revenues are comparatively more important (Chart 1). The share reporting lower income was also higher in the Mountain States, which includes Colorado where weaker wheat and dairy prices likely weighed on conditions. In Oklahoma, where cattle comprise a large share of farm revenue, three quarters of respondents indicated farm income was higher than a year ago.

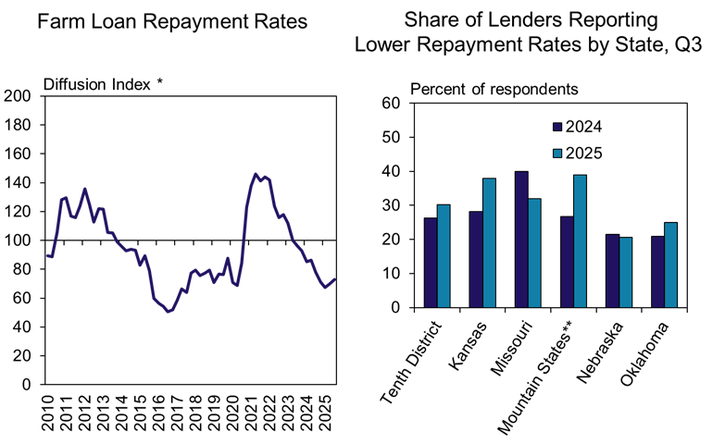

Agricultural credit conditions continued to deteriorate gradually alongside weaker farm finances. Farm loan repayment rates in the district declined at a pace similar to the previous quarter (Chart 2, left panel). The share of lenders reporting lower repayment rates inched higher in most states, reaching as high as 40% in Kansas and the Mountain States (Chart 2, right panel).

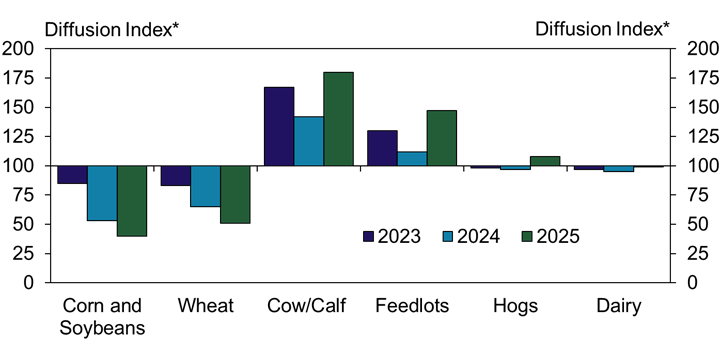

Tight profit margins have further reduced expectations about loan repayment rates for row crop operations. Lenders anticipated lower repayment rates for corn, soybeans and wheat operations through the end of this year, while repayment rates for cow/calf and feedlot operations were expected to improve (Chart 3). The outlook for repayment conditions for hog and dairy operations remained neutral, similar to previous years.

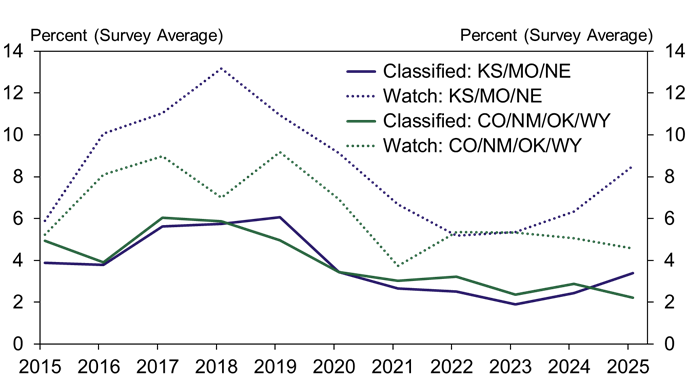

Farm loan performance declined in states most dependent on crop production, but was steady in states with heavier cattle production. Problem loan rates in Colorado, New Mexico, Oklahoma and Wyoming remained mostly flat compared with a year ago (Chart 4). Conversely, the average share of loans on watch and classified lists in Kansas, Missouri and Nebraska increased slightly to about 9% and 4%, respectively.

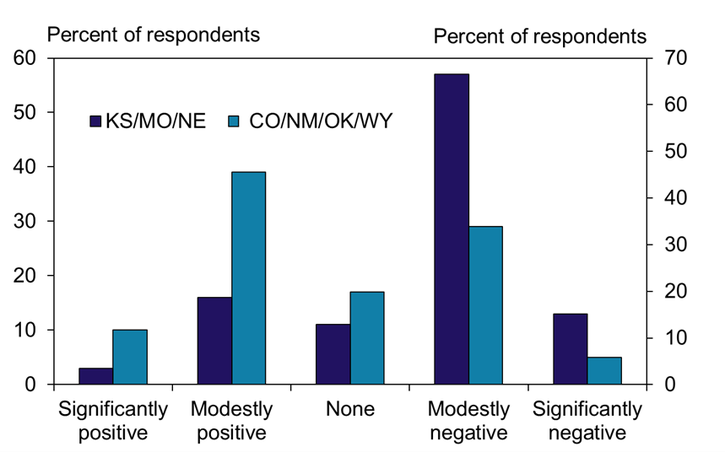

Disparities in conditions for the crop and livestock sectors have also spilled over to broader local economies. About half of lenders in states most heavily reliant on cattle revenues reported agricultural economic conditions have recently had a positive effect on the broader economy (Chart 5). However, 70% of lenders in Kansas, Nebraska and Missouri reported negative spillover of agricultural conditions to general economic conditions.

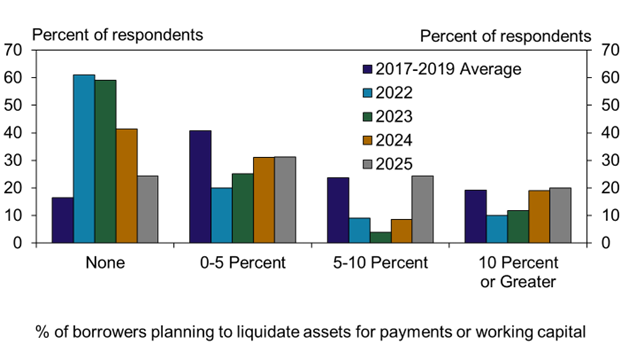

Financial challenges in the sector led to a modest increase in asset liquidation to boost working capital. Compared to previous years, considerably more lenders reported that between 5 to 10% of farm borrowers plan to sell assets before the end of the year to improve liquidity (Chart 6). The share of lenders reporting that borrowers had no plans to sell assets declined significantly from two years ago, from almost 60% to 20%.

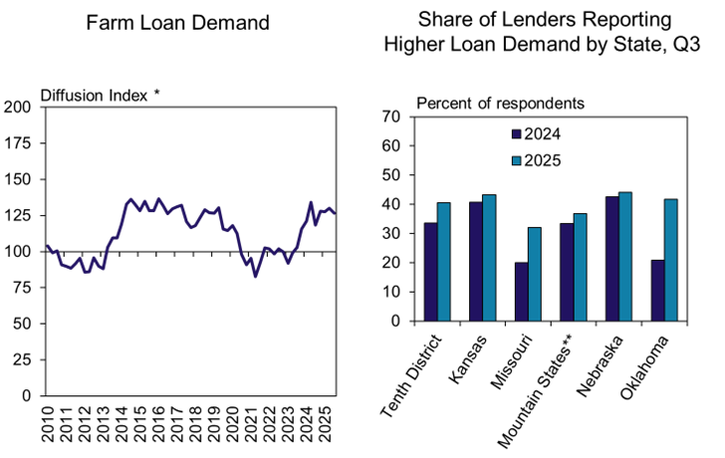

As liquidity in the farm sector continued to tighten, loan demand remained strong. Demand for non-real estate loans across the region increased at a pace similar to recent quarters (Chart 7, left panel). The share of lenders reporting higher demand than a year ago increased from last year in all states and was considerably larger in Oklahoma where strong cattle prices have likely increased the size and volume of livestock loans (Chart 7, right panel).

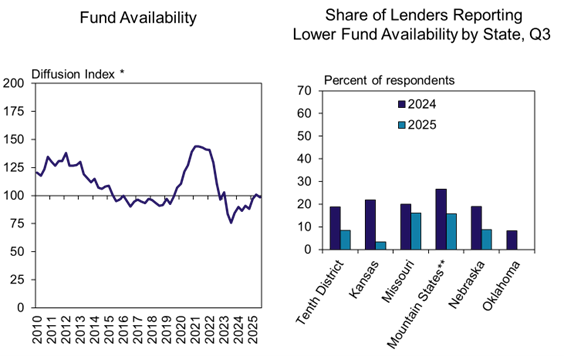

Despite consistent loan demand, availability of funds for farm lenders remained steady. After tightening slightly over the past year, fund availability was nearly unchanged across the district (Chart 8, left panel). The share of lenders reporting lower fund availability than a year ago declined in all states and was zero in Oklahoma (Chart 8, right panel).

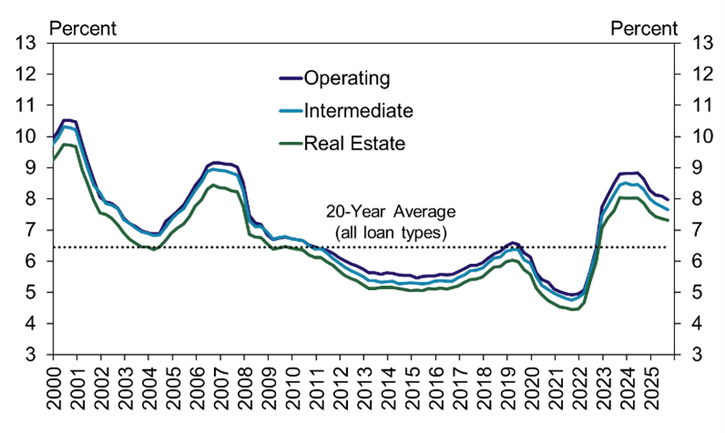

As credit conditions continued to tighten, farm loan interest rates declined slightly but remained slightly above recent historical averages. Average rates for operating loans and intermediate term debt declined about 10 basis points from the previous quarter, but remained about 120 basis points above the average of the past 20 years (Chart 9). The average rate on real estate loans dropped about 5 basis points since last quarter and was also about 120 basis points above the average over the past two decades.

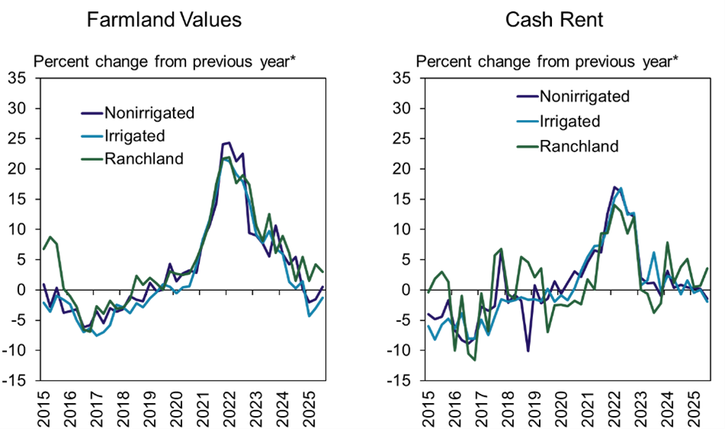

Despite modest pressure from interest rates and weaker farm finances, cropland values and cash rents were steady and ranchland values grew modestly. The average value of irrigated and non-irrigated cropland in the region changed by only about 1% from a year ago (Chart 10). Alongside strength in the cattle sector, ranchland values increased about 3%. Similar to land valuations, cash rents on cropland were slightly lower and ranchland rents increased about 4%.

COMMENTS

“Grain producers will have fantastic yields but face low prices and cattle producers are extremely profitable.”

“Crop yields in the area are expected to be much better than average; however, with the higher cost of inputs and lower crop prices crop farmers will be lucky to breakeven. Cow/Calf operations are the bright spot in the area with record cattle prices”

“Crop producers are struggling while livestock is flourishing. Government payments have helped, but not enough to save some producers.”

“Most borrowers are looking at cash flow shortages, however they still have significant equity in farm real estate.”

“Grain farmers are going to lose money on every acre of grain they’ve planted this year.”

“Farm incomes are higher due to government payments, but farmer sentiment seems to be dragging due to poor grain prices. Cow/calf folks are in better shape than ever before.”

“High cattle prices are helping tremendously”

“Cow/calf producers are experiencing record cattle prices and significant gross and net revenue growth.”

“The biggest effect of ag on the local economy would be equipment dealers, especially if they rely on sales more than service for revenue”

“Low commodity prices and higher living costs are our key concerns”

“We are continuing to see some slight deterioration and negative trends in our agricultural loan portfolio for crop farmers due to low grain prices.”

A total of 132 lenders responded to the Third Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District — an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri. Please refer questions to Ty Kreitman or Francisco Scott at 1-800-333-1040.