RMA administrator talks about crop insurance changes in past year

Insurance-RFP-021626

INDIAN WELLS, Calif. — Pat Swanson, an Iowa farmer and former crop insurance agent appointed by President Trump to run the Agriculture Department’s Risk Management Agency, said her highest priority since taking the job has been to reduce “burdensome regulation,” but that she has also learned that in Washington “you can’t switch on a dime.”

In a presentation to the Crop Insurance and Reinsurance Bureau, Swanson said she is commuting weekly from the farm she and her husband, Don, and their children have near Ottumwa, Iowa. She said growing up on the farm, she always worried about the local weather but she is now “worried about the weather nationwide.”

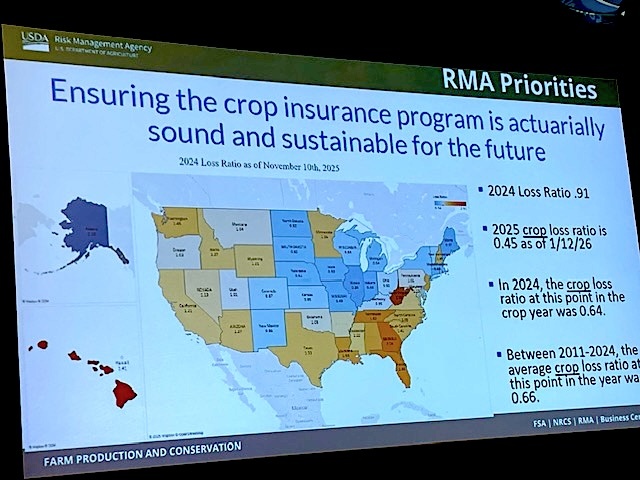

The nationwide loss ratio for crop year 2025 as of Jan. 12 is 0.45, which means that more premiums were paid for policies than indemnities paid for losses incurred, Swanson said. That’s better than 2024 when the loss ratio for the year was 0.91.

A map showed that the loss ratio varies by state, however. Swanson said she was happy there were no hurricanes in 2025.

Swanson noted that she has a computer science degree from Iowa State University and said she is “giddy” when she can sign bulletins that reduce regulations.

She also noted that RMA’s improper payment rate — a measure of overpayments and underpayments — in 2025 was 3.29%, higher than in 2022, 2023 and 2024, but below the latest available USDA improper payment rate of 6.91% in 2022.

Swanson showed slides demonstrating the growth of crop insurance and said the agency is developing a range of new policies and improving others.

The specialty crop industry has complained that fruit, vegetable, tree nut and floral growers are not treated fairly compared with row crop producers, and Swanson said she is holding roundtables with growers to determine how best to proceed.

The variety of policies means that the cost of crop insurance is one expense that farmers can control, Swanson said.