Growth in farm lending activity eases

Lending1-RFP-072825

Non-real estate farm lending at commercial banks declined slightly in the second quarter. According to the National Survey of Terms of Lending to Farmers, the volume of new non-real estate farm loans declined about 5% from the same time a year ago alongside a decrease in lending for most major purposes. Farm loan interest rates decreased slightly but remained relatively high. The share of new loans with variable rates remained historically low and average maturities on most types of loans remained above historical averages.

Conditions in the U.S. agricultural economy remained tenuous as relatively low crop prices continued to limit profit opportunities. Demand for farm financing increased swiftly over the past year alongside elevated production expenses and reduced liquidity in the sector. Strong revenues in livestock industries supported farm finances in some regions and distribution of ad hoc government assistance is likely to provide modest support to some growers. Despite easing in the growth of new lending activity in the second quarter, financing needs could still remain high alongside the outlook for continued weakness in crop prices.

SECOND QUARTER

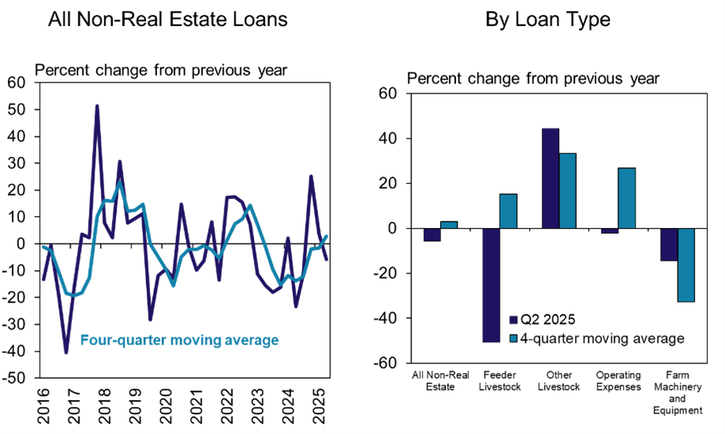

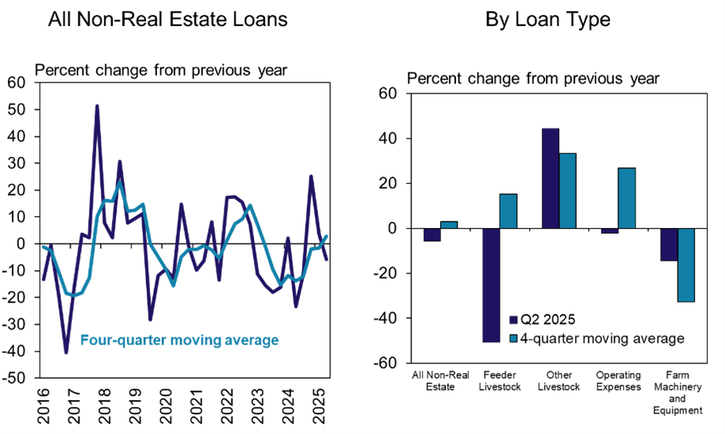

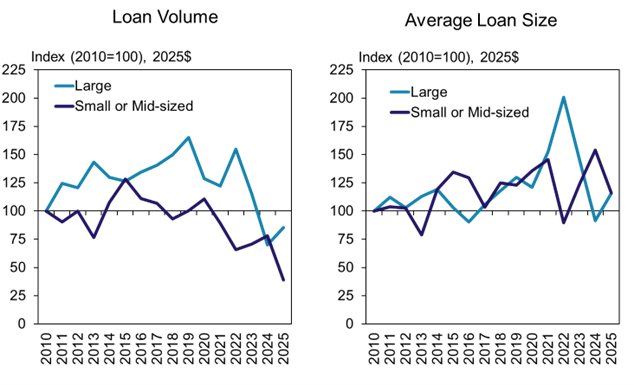

Growth in non-real estate farm lending eased during the second quarter of 2025. The volume of farm operating loans declined about 2% from the same time a year ago following strong growth that averaged about 25% over the past four quarters (Chart 1). Feeder livestock loans, which have historically been volatile, also declined considerably during the survey period but grew at an average pace of about 15% over the past four quarters.

Lending pulled back comparatively more at banks with the smallest farm loan portfolios. Loan volumes at small and mid-sized banks fell sharply this quarter, accelerating a downward trend in recent years, while lending at large banks increased 22%, partially reversing a sharp drop in 2024 (Chart 2, left panel). The average loan size at large banks also edged higher this quarter, in contrast to smaller loan sizes at small and mid-sized banks (Chart 2, right panel).

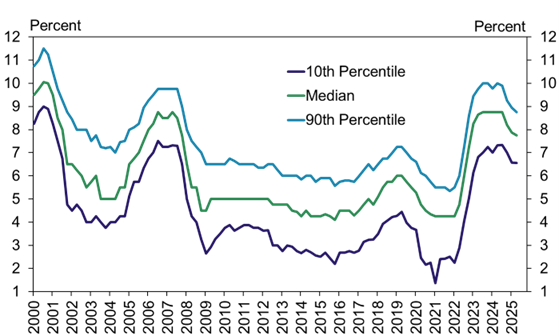

Farm loan interest rates declined slightly but remained relatively high. The median interest rate on farm operating loans was slightly less than 8% for the second consecutive quarter (Chart 3). The range of rates continued to vary relatively widely — from as high as 9% to as low as 6.5%.

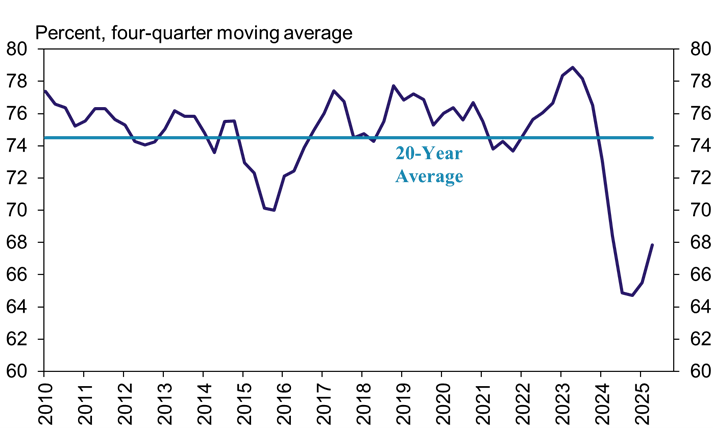

As farm loan interest rates have remained elevated, the share of loans with variable rates has been historically low. Despite a small uptick in variable-rate loan originations in the second quarter of 2025, that share remained well below historical levels (Chart 4). The use of variable rate loans have declined since 2024 alongside higher benchmark interest rates and a resilient U.S. economy.

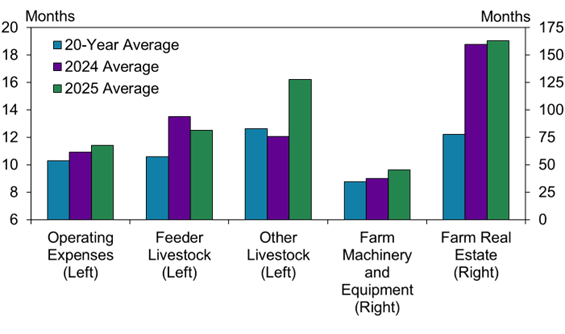

Average loan maturities continued to rise across most categories, exceeding historical averages. Maturities increased for loans related to operating expenses, farm machinery, and other livestock, while those for feeder livestock declined from a year ago (Chart 5). The average maturity on farm real estate loans reported in the survey has averaged more than 12.5 years (150 months) since 2024, about twice the 20-year average.